Acknowledging the scale and trajectory of greenhouse gas emissions is crucial to understanding the power of carbon markets in restoring carbon balance.

The Mission

Balancing 200 Years of Carbon Emissions

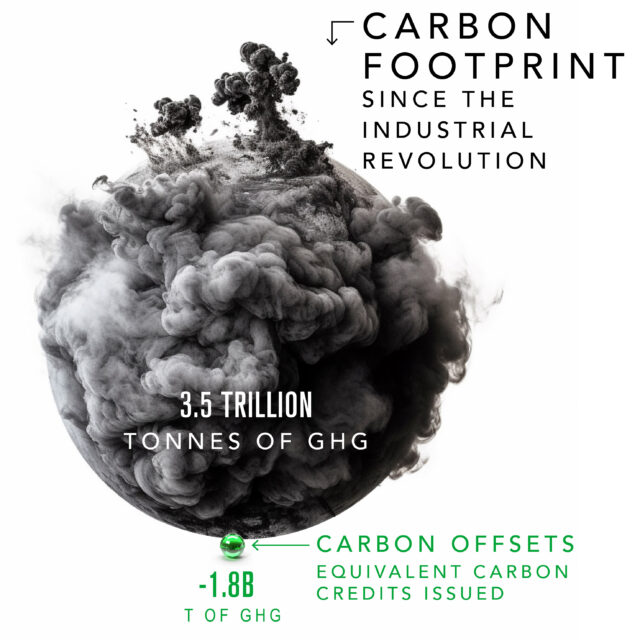

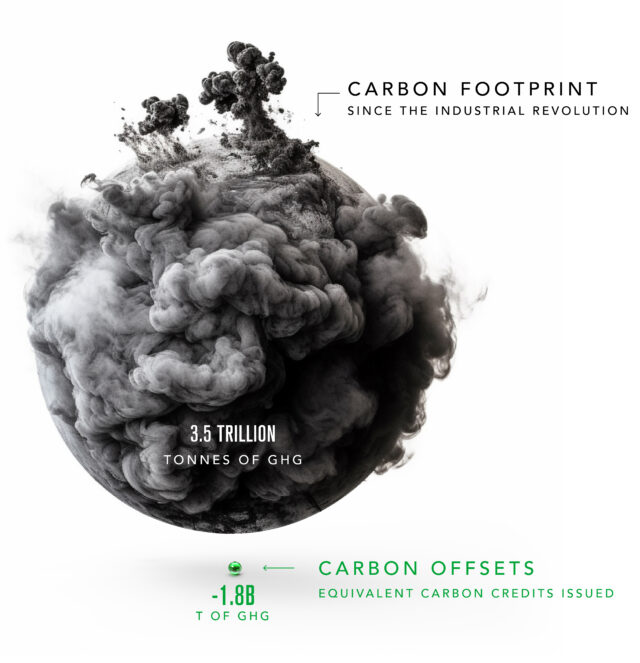

The Massive Scale of Human Emissions

Humans have released nearly 3.5 trillion tonnes of carbon dioxide into the atmosphere since the Industrial Revolution. Today only 1.8 billion of these emissions have been offset by carbon credits.

WHAT ARE CARBON OFFSETS?

A carbon offset or credit represents one tonne of greenhouse gas emissions reduced or removed by a project with a verified positive climate impact.

Purchasing carbon offsets allows companies or individuals to balance their emissions by funding projects making a positive climate impact. Rigorous third-party verification of these projects ensures that their impact is real, additional, and permanent.

Purchasing carbon offsets allows companies or individuals to balance their emissions by funding projects making a positive climate impact. Rigorous third-party verification of these projects ensures that their impact is real, additional, and permanent.

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

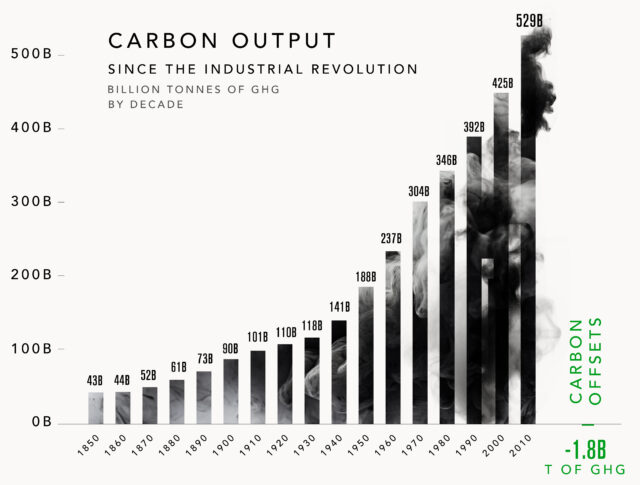

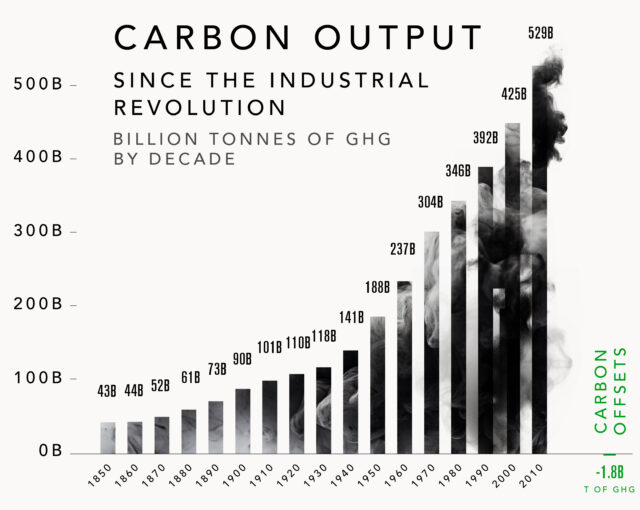

The Emission Explosion

Carbon emissions have dramatically increased since 1950 driven by the escalating energy and infrastructure demands from unprecedented economic growth and urbanization.

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

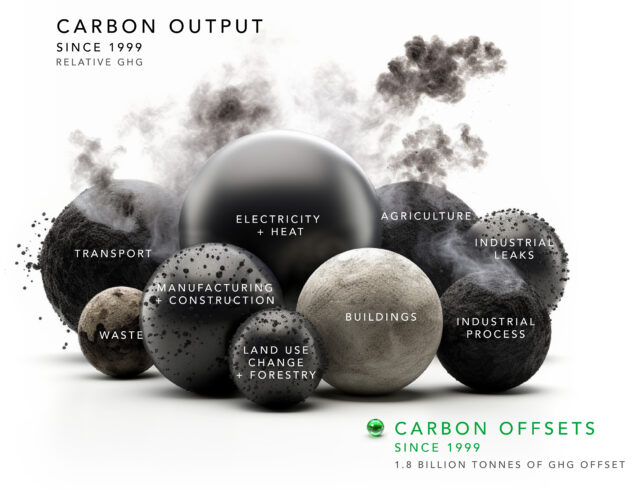

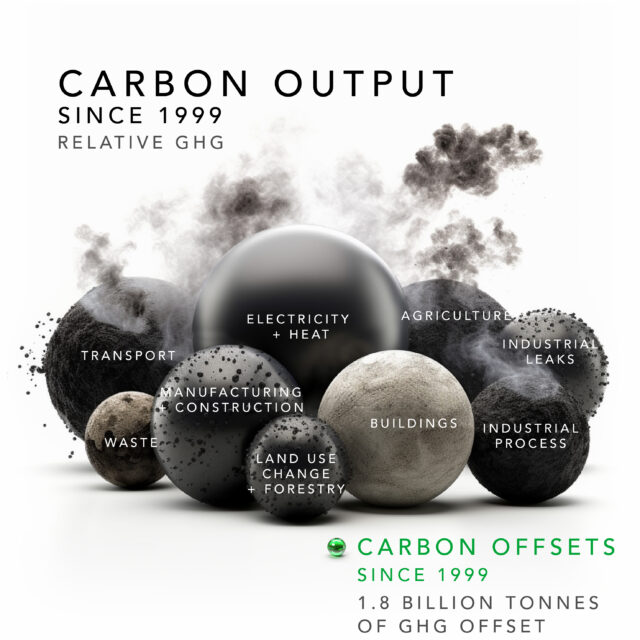

Breaking Down Emissions by Sector

Carbon credit trading started in the 1990s. All credits issued since then offset only 0.2% of emissions generated globally during that time.

Combating growing emissions requires a global effort to decarbonize polluting industries. But many emissions cannot be technically or economically reduced and must be offset; this will require significant investment into carbon offset projects.

Combating growing emissions requires a global effort to decarbonize polluting industries. But many emissions cannot be technically or economically reduced and must be offset; this will require significant investment into carbon offset projects.

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

Where do the Credits Come From?

Reforestation, forest conservation, and land use projects account for close to 40% of all offset issuances. This is followed by renewable energy projects, at 32% of issuances.

As the market expands, it is expected that the rising demand for high quality reduction and removal projects will increase credit issuances in agriculture, household and community, and carbon capture projects.

As the market expands, it is expected that the rising demand for high quality reduction and removal projects will increase credit issuances in agriculture, household and community, and carbon capture projects.

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

SHARE THIS GRAPHIC ON SOCIAL MEDIA

SOURCE:

ClearBlue Markets

The Exponential Promise of Carbon Markets

The annual supply of carbon credits is expected to reach 1 billion tonnes of CO2 equivalent per year by the end of the decade; a five-fold increase by 2030 relative to 2020.

Given the urgency for climate action, this estimate might in fact be conservative if carbon markets grow to the degree required to achieve carbon balance.

Given the urgency for climate action, this estimate might in fact be conservative if carbon markets grow to the degree required to achieve carbon balance.